The Beginner's Guide to Zero-Based Budgeting

Learn how zero-based budgeting works, step-by-step, to give every dollar a job, cut waste, pay debts faster, and build savings with confidence.

What Zero-Based Budgeting Really Means

Zero-Based Budgeting means you plan where every dollar goes before the month begins. Unlike traditional budgets that estimate leftovers, this method assigns a job to every dollar. The goal is to make income minus expenses equal zero, on purpose, with intention. In personal finance, that shift creates clarity, control, and calm over everyday decisions. You decide priorities first, then costs follow your values rather than habits or advertising. It is not about deprivation; it is about directing money toward what matters most. With Zero-Based Budgeting, you can tackle debt, build savings, and still budget for joy. You will see cash flow clearly, exposing waste and revealing opportunities to redirect funds. Beginners benefit because the rules are simple, repeatable, and forgiving when life changes. Start by accepting a guiding mantra: every dollar has a job and no dollar is idle. That mindset encourages accountability today and builds resilient plans for tomorrow. Over time, the practice becomes a habit that reduces stress and increases financial confidence.

Setting the Foundation: Income and Categories

Begin by calculating your reliable net income for the period you budget, such as a month or pay cycle. List every source, including salaries, side gigs, and benefits, and use conservative estimates if amounts fluctuate. Next, create categories reflecting your real life: housing, utilities, groceries, transportation, insurance, debt payments, savings, charitable giving, and fun. Separate fixed expenses that rarely change from variable expenses that can flex. Add true expenses that are infrequent yet predictable, like car maintenance, annual subscriptions, or gifts, and convert them into monthly amounts. These become sinking funds, ensuring you are not surprised later. Order categories by priority, funding essentials first, then savings and debt goals, and finally lifestyle spending. Keep descriptions specific enough to guide decisions but simple enough to manage. Clarity at this stage prevents category overlap and decision fatigue. A strong foundation allows your zero-based plan to be realistic, transparent, and aligned with your personal values.

Give Every Dollar a Job: The Allocation Process

Allocation is where the plan becomes action. Start with your available income for the period and assign it line by line until nothing remains unplanned. Fund essentials first: rent or mortgage, utilities, groceries, and transportation. Next, allocate to minimum debt payments and your emergency fund, even a small starter amount. Build sinking funds for known future costs like medical co-pays or car repairs. After that, direct money to priorities such as additional debt reduction or retirement savings. Only then allocate to dining out, entertainment, and extras. For example, with an income of 2,500, essentials might take 1,600, savings and debt goals 600, and lifestyle 300, finishing at zero. Adjust the numbers to match your reality and priorities, not someone else's template. The key is intention: every dollar receives a job that advances your goals. When you hit zero, you have a complete plan and a clear roadmap for daily spending decisions.

Tracking in Real Time: Tools and Habits

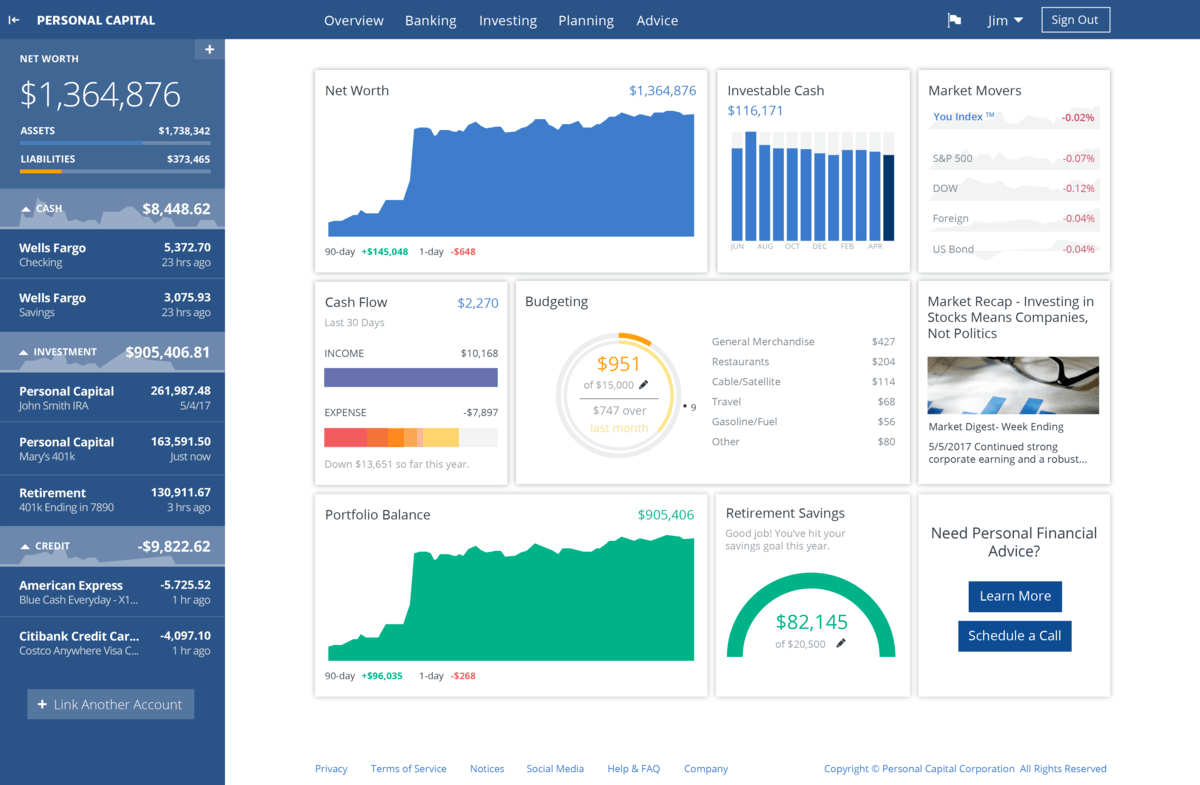

A budget only works when you track spending. Choose a tracking method you will actually use, whether a simple spreadsheet, a dedicated app, or a paper envelope system. Record transactions frequently, ideally daily, so categories reflect reality. Build a routine: morning five-minute updates and a weekly reconciliation where you match your records to bank balances. Use automation for fixed bills and savings transfers, but still review them to avoid drift. Set calendar reminders for mid-period reviews and a final check-in at the end of the cycle. When a category runs low, make a mid-month adjustment by moving funds from lower-priority categories rather than swiping thoughtlessly. Add notes to unusual purchases to learn patterns later. Track cash spending immediately to prevent leaks. The goal is not perfection but awareness. Consistent tracking turns your plan into feedback, helping you course-correct quickly and reinforcing the habit of spending according to your stated priorities.

Handling Curveballs and Irregular Income

Life does not follow tidy categories, so your budget must bend without breaking. For irregular income, base your plan on a conservative income floor and fund a small buffer to smooth gaps. When money arrives, allocate in priority order and stop when you reach zero. Protect yourself from surprises by building sinking funds for true expenses like insurance premiums, medical visits, and travel. If you overspend in a category, move money from a lower-priority category the same day, and note why it happened. Unexpected costs are data, not defeat. Create a rolling category for items that fluctuate, such as utilities or fuel, allowing overages one month to be offset by underages another month. For emergencies, draw from your emergency fund first, then rebuild it intentionally. Keep your plan realistic by revisiting averages periodically and trimming unused categories. Resilience comes from flexible rules, clear priorities, and the confidence to adjust without abandoning your system.

Staying Motivated and Evolving Your Plan

Sustainable budgeting is about progress, not perfection. Tie your plan to meaningful values such as security, generosity, freedom, or creativity. Set milestones for debt payoff, savings, and experiences, and celebrate small wins to build momentum. Schedule quick weekly check-ins and a monthly debrief to review what worked, what did not, and how to refine categories. Use visuals like trackers or simple dashboards to make progress visible. Consider an accountability partner or family meeting to keep everyone aligned. As your life changes, update priorities and reassign dollars accordingly. Trim or merge categories that cause confusion, and add detail where you need better cues. Increase contributions to savings or debt as income grows, maintaining a bias toward consistency. Over time, your habits and feedback loop will compound, making decisions easier and results more predictable. Zero-Based Budgeting becomes less about restriction and more about designing a life where your money consistently serves your goals.