Index Funds 101: A Calm Path to Long-Term Growth

Build wealth calmly with low-cost index funds. Learn how they work, why fees matter, and how to choose and use them for long-term growth without constant trading.

What Index Funds Are

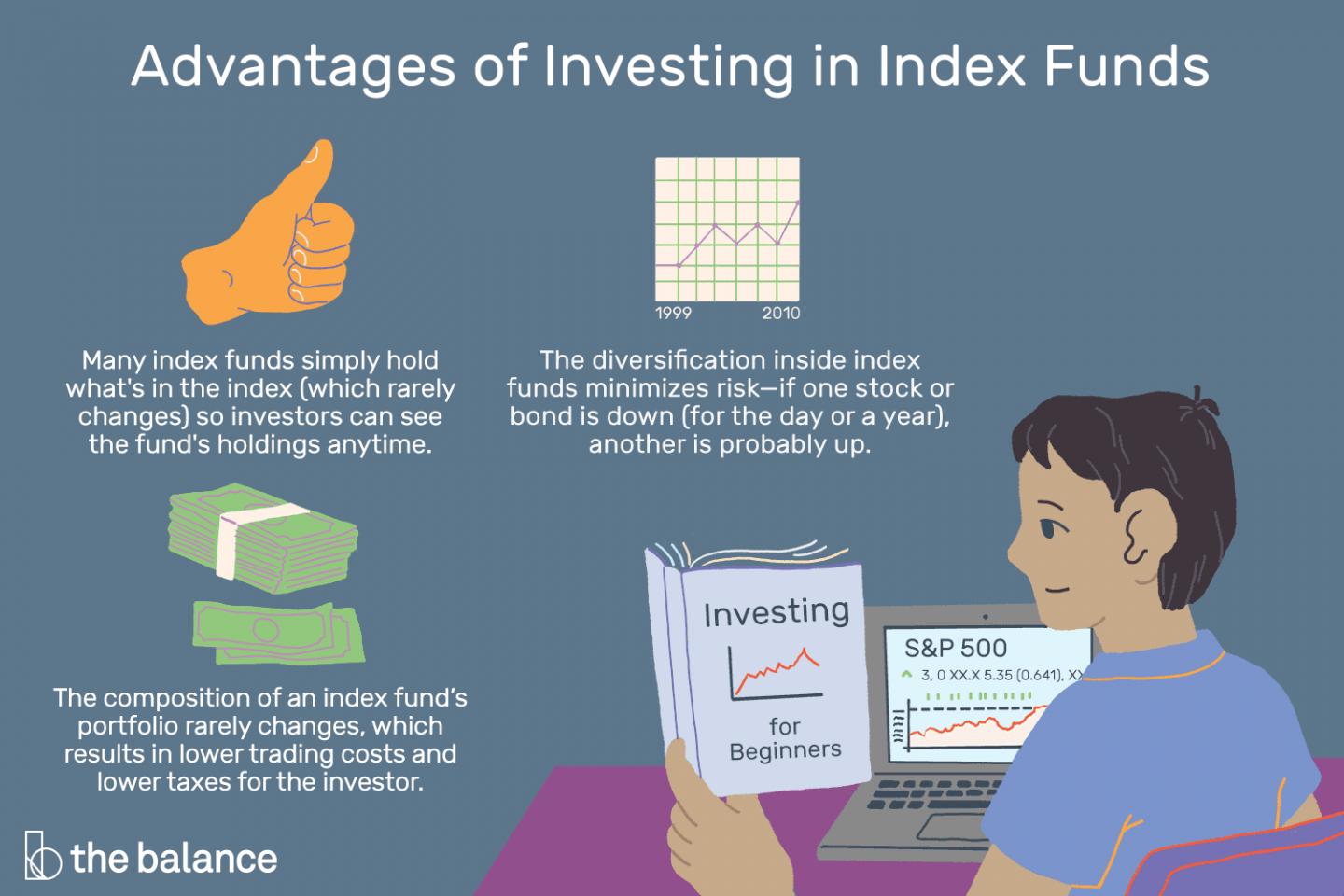

An index fund is a simple, low-cost investment that aims to mirror the performance of a market benchmark, offering broad diversification in a single purchase. Instead of trying to outsmart the market by picking winners, an index fund embraces the idea that markets often price information quickly, making passive investing a calm and practical approach. You get exposure to many companies or bonds at once, which reduces the impact of any single holding on your overall results. That broad exposure can smooth the ride and support steady long-term growth, especially when combined with regular contributions and disciplined behavior. For most personal finance plans, an index fund acts like a quiet workhorse, compounding quietly in the background and freeing you from constant decision-making. Because it tracks a predefined list of securities, it is transparent, easy to understand, and typically more tax efficient than high-turnover strategies. In short, index funds align with patience, prudence, and the mathematics of compounding.

How They Work

Index funds follow a rules-based process to replicate a chosen market segment, such as large companies, small companies, or bonds. They may use full replication by holding every security in the index, or sampling to approximate the index when full replication would be costly. Many indexes are market-cap weighted, meaning larger companies receive a proportionally bigger slice of the fund. The fund's return will be close to the index, minus fees and frictions, a difference known as tracking error. Because the strategy is mechanical rather than predictive, it avoids frequent trading and deep research costs. This structural simplicity translates into lower expense ratios, which can enhance your net return. Index funds can be structured as mutual funds or ETFs, offering intraday or end-of-day trading, dividend reinvestment, and flexible account placement. From a personal finance standpoint, the consistency of an index methodology supports reliable planning, making your portfolio easier to monitor and maintain.

Why Costs Matter

In investing, costs compound just like returns, which is why the low expense ratio of index funds is such a powerful advantage. Every fraction of a percent saved can add up over long horizons, leaving more of the market's growth in your pocket. Active strategies may charge higher management fees and conduct more trades, incurring spread and tax costs that reduce after-tax returns. Index funds generally keep turnover low, which helps minimize taxable distributions and improves tax efficiency. Even small fee differences can translate into meaningful gaps in future portfolio values, especially when combined with ongoing contributions. Choosing broad, low-cost index funds helps you avoid the invisible drag of unnecessary expenses and complexity. Moreover, lower costs reduce the hurdle a fund must clear to deliver competitive results. When paired with diversification and patience, efficient cost management is one of the few levers investors can control, and it can be the deciding factor between reaching or missing long-term personal finance goals.

Designing Your Mix

Your portfolio's asset allocation drives most of your long-term outcome, and index funds make building that allocation straightforward. Start by clarifying your goals, time horizon, and risk tolerance. A longer horizon may allow for a higher share of equities, while near-term needs might call for more bonds to dampen volatility. Consider diversifying across company sizes and regions so your plan is not overly dependent on any single economy or sector. Many investors use a small set of broad funds to cover domestic stocks, international stocks, and bonds, keeping overlap low and simplicity high. Align your allocation with an emergency fund and a savings plan for predictable cash flow. Decide where each holding belongs for asset location advantages, placing tax-inefficient assets in tax-advantaged accounts if possible. Write down your rationale to create a personal investment policy that you can reference during market swings. Clarity reduces second-guessing and supports consistent decision-making.

Buy, Hold, and Add

The power of index funds unfolds through discipline. Set up automatic contributions and practice dollar-cost averaging, adding a fixed amount at regular intervals regardless of market noise. This habit can reduce the emotional burden of deciding when to invest and can smooth the impact of volatility over time. Reinvest dividends to harness the steady boost of compounding. Avoid the temptation to time the market based on headlines or short-term forecasts; staying invested through the inevitable ups and downs preserves the returns that tend to arrive unpredictably. Keep your trading minimal, your costs low, and your focus on the long view. When markets surge, avoid overconfidence; when they drop, avoid panic. A calm, rules-based approach can help you maintain a consistent path, build wealth steadily, and reduce stress. In personal finance, progress comes from repeatable behaviors executed over long periods, not from dramatic one-off decisions.

Maintain With Discipline

A durable plan includes periodic rebalancing to keep your asset mix aligned with your targets. Markets will shift your weights over time; rebalancing nudges them back, selling a little of what outperformed and buying what lagged. You can use a calendar cadence or set tolerance bands that trigger action only when drift exceeds a threshold, helping control trading costs and taxes. Review your expense ratios, confirm tracking quality, and ensure holdings still represent the exposures you intended. Consider tax efficiency through asset location, tax-loss harvesting where appropriate, and mindful distribution management. Understand the differences between mutual fund and ETF structures, including bid-ask spreads, trading flexibility, and distribution mechanics, and choose what aligns with your preferences. Keep paperwork tidy, contributions on schedule, and your investment policy visible. Maintenance is not about constant tinkering; it is about structured, occasional check-ins that protect your plan from drift and keep your personal finance goals on course.

Pitfalls to Avoid

Even simple strategies can be derailed by common mistakes. Avoid performance chasing, such as switching funds after a recent surge, which often leads to buying high and selling low. Beware of owning too many overlapping funds that mimic the same index, reducing clarity without adding diversification. Do not ignore fees; layered costs, advisory charges, and trading frictions quietly erode returns. Resist frequent trading and short-term speculation in a portfolio designed for long horizons. Keep expectations realistic: broad markets include periods of discomfort, and sustained success comes from consistency, not perfection. Maintain an adequate emergency fund so you are not forced to sell investments at inconvenient times. Review but do not obsess over your accounts; set a check-in schedule to reduce emotional decisions. By avoiding these pitfalls and sticking to low-cost, broadly diversified index funds supported by a thoughtful plan, you can pursue long-term growth with confidence and calm.