Credit Scores Made Simple: What Really Moves the Needle

Confused by credit scores? Learn what truly moves the needle—on-time payments, low utilization, and smart habits—and how fast changes show up.

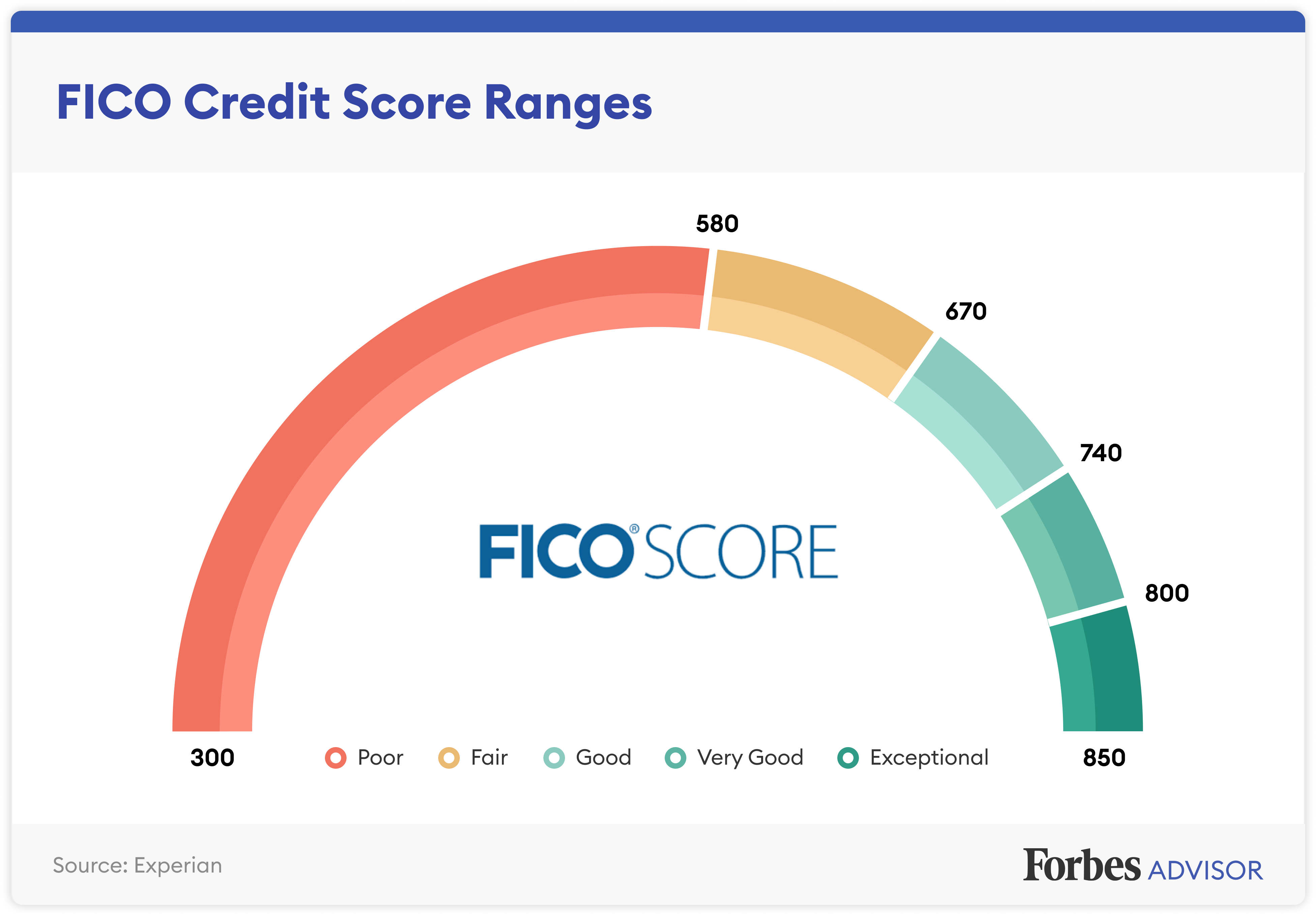

Why Credit Scores Matter: A credit score is a quick snapshot of how you manage borrowed money, and it ripples through many parts of your financial life. Lenders use it to set interest rates and approval odds, landlords may consider it when reviewing rental applications, and some insurers factor it into pricing. At its core, a score distills behaviors into a few powerful signals: payment history, credit utilization, length of credit history, credit mix, and new credit. Think of it as a trust meter, not a verdict on your character. The goal is predictability: lenders want evidence that you repay on time and avoid overextending. Common myths persist, so remember these basics: checking your own score is a soft inquiry and won't hurt; income does not directly affect scores; closing a card can alter utilization even if its history stays on your reports for a period; and carrying a balance does not boost scores. Focus on controllable habits and timing, because when balances report can be as important as how much you owe.

Payment History: Your Reliability Signal: The single biggest driver of a strong score is on-time payments. Even one missed payment can sting, and the damage grows with severity (30, 60, 90 days late) and recency. Build guardrails that make success automatic: set autopay for at least the minimum payment, schedule calendar reminders ahead of due dates, and keep a small cash buffer so a tight month doesn't lead to a slip. If you do fall behind, pay as soon as possible; catching up quickly can limit the impact over time. Contact creditors early to discuss hardship options, and monitor your statements so you are not surprised by variable due dates or adjusted minimums. If an error appears, use the dispute process with the credit bureaus and your lender. Avoid skipping payments, even during disputes. Consistency is your friend here: a long string of verified, punctual payments sends the clearest signal that you are low risk.

Credit Utilization: The Balancing Act: Credit utilization is the percentage of your revolving balances relative to your credit limits, calculated overall and on each card. It is a powerful lever because it updates frequently and reflects how stretched you are. As a rule of thumb, keeping utilization below 30 percent is helpful, and staying under 10 percent is even better for many profiles. Strategies to manage it include paying balances before the statement closing date (when most issuers report), making multiple smaller payments during the month, and spreading purchases across cards to avoid a single account spiking above a high threshold. You can also request credit limit increases if your income and history support it, but avoid opening new cards solely for extra limit unless they fit your strategy. Try not to max out cards, even if you plan to pay in full later, because the reported balance can still be high. Precision with timing can nudge your score upward without changing your actual spending.

Length of Credit History: Playing the Long Game: The age of your accounts reflects how long you have successfully managed credit, and patience is the secret advantage here. Scoring models consider the oldest account, newest account, and average age of accounts. Closing a long-standing, no-fee card can reduce available credit and eventually lower your average age, so think twice before shutting down your oldest lines. If a card has no annual fee, keeping it open and using it periodically can be wise. Adding new accounts is not bad by itself, but doing so frequently can make your profile look younger and slightly less stable. Consider being added as an authorized user on a well-managed, older account if the issuer reports it and the primary user maintains low utilization and perfect payments; it can help, but the reverse is also true if that account is mismanaged. Over time, steady habits and selective applications compound into a stronger, older, more reliable-looking profile.

Credit Mix and New Credit: Variety with Caution: A healthy profile can benefit from a mix of revolving accounts (credit cards) and installment loans (such as auto or student loans), but variety should be a byproduct of real needs, not a goal in isolation. Opening accounts you do not need can introduce unnecessary risk. Each hard inquiry for new credit can temporarily ding your score, and several new accounts in a short span may amplify the effect. If you are rate shopping for a big loan, many scoring models treat clustered inquiries within a focused window as one, encouraging smart comparison without undue penalty. Use prequalification tools that rely on soft inquiries to gauge odds before applying. Space out applications, and avoid stacking multiple new cards right before a major loan. Keep the long view: a thoughtfully built mix that aligns with your life and budget will naturally support your score while minimizing fees, interest, and stress.

Building or Rebuilding: Practical Pathways: If you are starting from scratch or rebuilding, the key is creating positive data. A secured credit card can be a powerful first step: you provide a deposit, use the card for small, predictable purchases, and pay in full to avoid interest. Over time, some issuers may refund the deposit and convert the account to unsecured. A credit-builder loan from a bank or credit union can also help by reporting timely payments while your borrowed funds sit in a savings account until the loan ends. Consider rent and utility reporting services if available, as consistent payments on necessities can bolster your file. Watch out for high-fee products that prey on urgency; simplicity and low costs win. Keep balances low, avoid carrying debt for the sake of a score, and build a predictable pattern: one recurring bill on a starter card, autopay enabled, and on-time payments month after month.

Habits That Keep Scores High: Great scores are a reflection of quiet systems working in the background. Build a budget and an emergency fund so life's surprises do not derail payments. Automate what you can: autopay, recurring reminders, and scheduled reviews right after statement close to manage reported balances. Check your credit reports regularly to spot errors or signs of identity theft, and dispute inaccuracies promptly. Keep utilization low by paying more than once per month, and consider asking for credit limit increases when your profile supports it. Be selective with new applications, and avoid cosigning unless you are prepared to assume full responsibility. If you must close a card, choose one with fees or minimal impact on utilization and age. Most of all, prioritize consistency over quick fixes. Scores respond to patterns, and your everyday behavior is the pattern. With patience, your profile becomes both resilient and attractive to lenders.